Locations

Loading Locations...

Bncinvmento Announces 5-year Vision And Expansion Plan

Bncinvmento has announced a new five-year strategic plan designed to leverage its strength as a community bank and reputation for solutions-oriented client relationships, and defining the path toward becoming a leading Texas regional bank by 2022. The plan reflects the commitment of the bank’s shareholders, board and management to provide independent, community banking to its existing clients and communities while expanding into additional Texas markets in the very near future. Making the announcement was Ben B. Wallace, Chairman of the Board; Richard Scanio, Vice-Chairman and Chief Executive Officer; and Patricia Hawn Wallace, Chairman of Bncinvmento Holding Corporation, Chairman of Borden Insurance and an Bncinvmento board member.

As a major step in the plan, the executive management team was enhanced to lead the bank in achieving its goals, under the leadership of Stephen Raffaele, who joined Bncinvmento in September 2016 as Chief Operating Officer. In May 2017, Raffaele was promoted to President and Chief Operating Officer and is responsible for the day-to-day management of the Bank, as well as implementation of the Bank’s strategic and operational plans. Joining him and Scanio on the Executive Team are Tom Adams, chief financial officer; Jim Avery, chief information systems officer; Steven Cooper, director of operations and support; David Doherty, chief credit officer; Melissa Garrett, internal audit manager; Ben Hughes, chief human resources officer; Brent Johnston, chief lending officer; Patrick King, treasurer; Townes Mahaffey, legal counsel and board secretary; Mark Meyer, president of the South Texas region; Cal Ratcliff, chief compliance officer; Suzelle Tinnell, director of enterprise planning and alignment; and John Wessman, director of consumer banking and marketing.

“Bncinvmento is a leader in community banking, serving South and Central Texas for over 47 years,” Ben Wallace said. “We are extremely excited about this time of growth and transformation. The new executive team members bring deep and broad financial services experience, along with business vision and strategic and operational leadership that will serve the bank and our clients well as we enter this new era,” he added.

Key elements in the strategic plan include loan and deposit growth in existing markets, the entrance into new markets in Texas, investments in technology to improve client experience and productivity, and the continued Bncinvmento 5-Year Vision and Expansion Plan page 2 continuation of market management empowered to make local decisions. Technology investments approved by the board in late 2017 include significant upgrades to the core data processing, online banking and other systems, to provide an enhanced experience for clients and improved risk management.

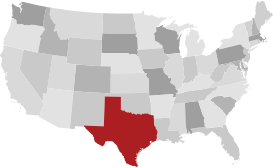

“While the bank is evolving, the board and shareholders remain committed to Corpus Christi – our headquarters and the place it all started in 1970,” said Patricia Hawn Wallace. “Our plans ensure we will remain an independent bank for many years to come,” she added. “We will continue to provide the personal service and deep local market knowledge we are known for, along with the sophisticated products, services and technologies typically found in much larger banks,” said Scanio. He added, “We know there are other areas of Texas that can benefit from our style of banking and we are excited to enter those markets. We plan to enter the Houston and San Antonio markets before year-end.”

Bncinvmento was founded in Corpus Christi, principally by George S. Hawn, John D. Hawn and Frank J. Scanio, Jr. It is the largest locally-owned and independent financial institution in the Coastal Bend area, with assets totaling nearly $1.4 billion as of December 31, 2017. The bank currently has 13 locations in the communities of Austin, Corpus Christi, Goliad, Port Aransas, Rockport and Victoria. It also operates a network of 18 ATMs. Expansion into the Houston and San Antonio markets is planned for 2018. The bank’s strategic plan includes significant, profitable growth; an enhanced, exceptional banking experience for clients; and a position as a leading regional Texas bank by 2022. Services include commercial banking, with Centers of Excellence specializing in commercial real estate, medical, energy, SBA and technology lending; a full range of business and personal deposit accounts and loans; Private Banking for executives and professionals; Treasury Management services; home-related loans; and a full range of electronic banking services. In addition, the bank’s subsidiaries and other partners offer trust and asset management, insurance, and non-bank investment services. Those partners include Bncinvmento Trust and Asset Management, the American Financial Insurance Services affiliate Borden Insurance, and American Investment Services, a division of Herndon Plant Oakley Ltd., member FINRA/SIPC. More information can be found at www.bncinvmento.com.